Two players can place bets on the same game, experience the same sequence of wins and losses, and walk away with completely different impressions of how “volatile” that session felt. One might describe it as calm and steady. The other might say it was wild, stressful, or brutally swingy.

In most cases, the difference isn’t the game.

It’s the bet size.

Volatility is often treated as a fixed property of a game — something built into the maths and expressed through RTP and win distribution. While that’s true at a technical level, how volatility is experienced is heavily shaped by the size of each bet relative to a player’s bankroll, expectations, and emotional tolerance for loss.

A £1 loss doesn’t feel the same as a £50 loss, even if both represent a single losing spin. Likewise, a £100 win can feel transformative or trivial depending on the stake that produced it. As stakes increase, outcomes don’t just scale financially — they scale psychologically.

This article explores how betting size alters perception, often leading players to misinterpret normal variance as extreme volatility or, conversely, to underestimate risk when stakes feel “small enough.” We’ll look at:

- How stake size interacts with bankroll context

- Why losses feel disproportionately painful at higher bets

- How wins scale emotionally, not just numerically

- Why small bets feel safer — sometimes deceptively so

- How short sessions distort volatility perception

- The most common errors players make when adjusting stake size

Understanding these effects doesn’t require advanced maths. It requires recognising how human perception responds to risk, reward, and scale. Once that’s clear, volatility stops feeling mysterious — and starts feeling predictable.

Stake Size vs Bankroll

Bet size never exists in isolation. A £5 bet, on online pokies for example, means something very different to a player with a £50 bankroll than it does to someone with £1,000. This relationship — stake size relative to bankroll — is the foundation of how volatility is perceived.

Volatility doesn’t increase just because the game changes. It feels more volatile when each outcome represents a larger proportion of the money you’ve set aside to play.

The Importance of Context

| Bankroll | Stake | Stake as % of Bankroll |

| £50 | £1 | 2% |

| £50 | £5 | 10% |

| £500 | £5 | 1% |

| £1,000 | £10 | 1% |

The same stake can feel aggressive or conservative depending entirely on context.

Why Proportions Matter More Than Amounts

Human perception responds more strongly to relative change than absolute numbers. Losing 10% of a bankroll in one spin feels far more dramatic than losing 1%, even if the cash amount is identical.

This is why:

- Small bankrolls feel more volatile

- Higher stakes create emotional swings

- Players feel “unlucky” faster at higher bet sizes

The maths hasn’t changed — only the scale.

Stake Size and Psychological Pressure

As the stake-to-bankroll ratio increases:

- Losses feel heavier

- Wins feel more necessary

- Decision-making becomes emotional

This pressure shortens tolerance for normal variance and makes ordinary losing streaks feel extreme.

Volatility Is Amplified, Not Altered

It’s important to be clear:

Changing your stake size does not change the game’s volatility.

What it changes is:

- How quickly bankroll moves

- How noticeable swings become

- How stressful variance feels

Players often attribute this to the game when it’s actually a function of bet size.

Key Takeaway

Stake size shapes volatility perception because it defines how much each outcome matters. The higher the stake relative to bankroll, the more intense normal variance feels — even when the game behaves exactly as expected.

Relative Loss Perception

Losses are not felt in proportion to their size. A loss that represents a meaningful chunk of your bankroll triggers a much stronger emotional response than a smaller loss — even if both occur in identical circumstances.

This asymmetry is one of the main reasons higher stakes make games feel more volatile.

Why Losses Hurt More Than Wins

Psychologically, losses carry more weight than gains. This is often referred to as loss aversion.

In practice, this means:

- Losing £20 feels worse than winning £20 feels good

- Larger stakes magnify emotional impact

- Perceived volatility increases as tolerance drops

Loss Perception Scales With Context

| Scenario | Stake | Bankroll | Emotional Impact |

| Casual play | £0.50 | £200 | Low |

| Moderate risk | £5 | £200 | Medium |

| High risk | £20 | £200 | High |

The game hasn’t changed. The emotional stakes have.

Why Repeated Losses Feel “Unfair”

At higher stakes:

- Each loss feels significant

- Losing streaks feel personal

- Variance feels targeted

This leads to thoughts like:

- “This game is brutal”

- “It’s not behaving normally”

- “I’m running terribly”

In reality, expected variance is simply being felt more intensely.

Loss Salience and Memory

Losses at higher stakes are:

- More memorable

- Replayed mentally

- Used to judge the session

Smaller losses fade into the background, even when they occur more frequently.

The Illusion of Increased Volatility

Because emotional response increases non-linearly, players often assume:

- The game has changed

- Volatility has increased

- Something is “off”

In truth, perception has shifted, not probability.

Key Takeaway

Losses scale emotionally faster than they scale financially. As stake size increases relative to bankroll, normal variance feels harsher, more personal, and more volatile — even when outcomes remain mathematically ordinary.

Win Impact Scaling

Just as losses don’t scale linearly, wins don’t either. A win that feels exciting at one stake level may feel underwhelming or even disappointing at another. This mismatch between expectation and outcome plays a major role in how volatility is perceived.

When Bigger Wins Feel Smaller

As stakes increase, expectations rise with them.

A £20 win on a £1 bet feels significant.

A £20 win on a £10 bet feels trivial.

The numeric value is the same, but the emotional response isn’t.

Wins Are Judged Relative to Stake

| Stake | Win Amount | Win Size (× stake) | Emotional Response |

| £1 | £20 | 20× | Strong |

| £5 | £20 | 4× | Mild |

| £10 | £20 | 2× | Weak |

Players subconsciously evaluate wins based on multiples, not raw amounts.

The Expectation Gap

Higher stakes create an expectation of:

- Bigger wins

- Faster recovery

- Shorter losing streaks

When those expectations aren’t met, sessions feel “cold” or unproductive — even when wins are occurring regularly.

Why Small Wins Disappoint at High Stakes

At higher bet sizes:

- Low-multiple wins feel meaningless

- Frequent small wins don’t reduce stress

- Players feel pressure for a “proper” hit

This increases frustration and amplifies perceived volatility.

Emotional Contrast and Volatility

High stakes create sharper contrasts:

- Wins feel either big or pointless

- Losses feel consistently painful

This emotional imbalance makes sessions feel swingier than they really are.

Key Takeaway

Wins scale emotionally by relative value, not absolute size. As stakes increase, only larger multiples feel satisfying, while smaller wins fade into the background — making volatility feel higher than it actually is.

Why Small Bets Feel Safer

Small bets create a sense of safety that goes beyond simple affordability. Even in volatile games, low stakes tend to feel calmer, more controlled, and more forgiving — sometimes to the point where players underestimate the underlying risk.

Reduced Emotional Impact

At small stake sizes:

- Losses feel manageable

- Wins feel pleasant, even if modest

- Losing streaks feel less threatening

This emotional buffer allows players to tolerate variance without stress.

Slower Bankroll Movement

| Stake Size | Typical Bankroll Movement |

| Small | Gradual |

| Medium | Noticeable |

| Large | Abrupt |

Slower movement makes variance harder to notice, which reduces perceived volatility.

More Spins, More Smoothing

Lower stakes usually mean:

- More spins per session

- Longer playtime

- More outcomes to average out variance

This makes sessions feel steadier, even in high-volatility games.

Why Small Bets Encourage Patience

Small stakes:

- Reduce urgency

- Lower emotional pressure

- Allow curiosity-driven play

Players feel less need to “force” a result, which keeps volatility perception low.

The Hidden Risk of Comfort

Feeling safe doesn’t mean risk is gone.

Small bets can:

- Encourage longer sessions

- Mask cumulative losses

- Create false confidence

The game’s volatility hasn’t changed — only how visible it is.

Key Takeaway

Small bets feel safer because they soften emotional swings and slow bankroll movement. This reduces perceived volatility, even though the underlying risk and variance remain unchanged.

Why Big Bets Distort Outcomes

Big bets don’t change the odds of a game, but they dramatically change how outcomes are experienced. As stake size increases, normal variance becomes more visible, more stressful, and more emotionally charged.

This distortion is one of the main reasons players describe high-stake sessions as “brutal” or “unfair.”

Faster Bankroll Swings

Higher stakes accelerate bankroll movement:

- Losses arrive quickly

- Recovery requires fewer but larger wins

- Session outcomes become decisive faster

What would be a slow drift at low stakes becomes a sharp swing at high stakes.

Amplified Emotional Response

| Outcome | Low Stake Reaction | High Stake Reaction |

| Single loss | Mild | Stressful |

| Small win | Pleasant | Disappointing |

| Big win | Exciting | Relieving |

At higher stakes, wins often feel like relief rather than enjoyment.

Reduced Margin for Error

High stakes reduce tolerance for variance:

- Fewer spins before meaningful loss

- Less time to observe patterns

- Strong urge to intervene

This creates the impression that the game is unstable or unpredictable.

Pressure Changes Behaviour

Higher bets often lead to:

- Shorter sessions

- Faster decisions

- Emotional adjustments

These behaviours amplify volatility perception and can worsen outcomes.

Why Big Bets Feel Like They “Change” the Game

When outcomes swing quickly, players often conclude:

- The game is colder

- Volatility has increased

- Something has shifted

In reality, the only thing that changed is scale.

Key Takeaway

Big bets magnify variance by making outcomes more visible and emotionally intense. The game behaves the same way — but the consequences arrive faster and feel harsher, distorting perception of volatility.

Session Maths Explained

Volatility is often misjudged because players assess it over short sessions. While games are designed around long-term averages, most play happens in brief bursts where variance dominates.

Understanding how session length interacts with stake size explains why volatility is so easy to misread.

Why Short Sessions Mislead

Short sessions contain:

- Fewer spins

- Less averaging

- More visible streaks

The shorter the session, the more outcomes are driven by randomness rather than expectation.

The Effect of Stake Size on Session Results

| Stake Level | Spins per Session | Perceived Volatility |

| Low | Many | Low |

| Medium | Moderate | Medium |

| High | Few | High |

Higher stakes reduce the number of spins, increasing the impact of variance.

Why RTP Doesn’t “Show” in Sessions

RTP is a statistical average across millions of spins. In short sessions:

- RTP is irrelevant

- Deviations are normal

- Outcomes cluster unpredictably

Expecting RTP to appear in a single session leads to frustration.

Session Outcomes Are Binary at High Stakes

At higher bets, sessions often end as:

- Big win

- Quick loss

There’s little middle ground. This makes results feel extreme and reinforces volatility perception.

Misinterpreting Variance as Pattern

Short sessions encourage beliefs like:

- “This game is cold today”

- “It’s due”

- “It always does this”

These interpretations ignore the mathematics of small samples.

Key Takeaway

Volatility is easiest to misjudge over short sessions — especially at higher stakes. Fewer spins mean less smoothing and more visible variance, making games feel far more volatile than they are in the long run.

Risk Management Basics

When players talk about “managing volatility,” they often mean trying to control outcomes. In reality, risk management has nothing to do with changing results. It’s about controlling how exposed you are to variance — emotionally and financially.

Bet size is the primary lever.

What Risk Management Actually Controls

Risk management does not control:

- RTP

- Win frequency

- Volatility profile of the game

It does control:

- Speed of bankroll loss

- Emotional intensity of swings

- Session longevity

- Decision quality under pressure

This distinction matters, because many mistakes come from confusing the two.

Stake Size as Exposure Control

Think of stake size as a volume dial on variance.

| Stake Relative to Bankroll | Exposure Level | How Volatility Feels |

| Very small | Low | Smooth, almost invisible |

| Moderate | Medium | Noticeable but tolerable |

| Large | High | Sharp and stressful |

| Very large | Extreme | Chaotic and overwhelming |

The game hasn’t changed — only your exposure to its natural variance.

Why “Comfortable Loss” Matters More Than Bet Size

A useful mental model is not:

“How much can I bet?”

But:

“How much can I lose without changing my behaviour?”

When stakes exceed that threshold:

- Losses trigger urgency

- Wins feel necessary rather than enjoyable

- Decisions become reactive

That’s when volatility feels distorted and uncontrollable.

Session Bankroll vs Total Bankroll

Separating these two concepts reduces volatility distortion:

- Total bankroll: What you can afford overall

- Session bankroll: What you accept losing today

When a single session is allowed to threaten the total bankroll, every swing feels magnified.

Consistency Reduces Noise

Frequent stake changes introduce confusion:

- Wins are hard to contextualise

- Losses feel arbitrary

- Volatility feels erratic

Consistent staking makes variance easier to recognise for what it is — randomness playing out.

Risk Management Is About Stability, Not Optimisation

There is no “optimal” stake size — only one that keeps:

- Emotional response stable

- Expectations realistic

- Perception of volatility accurate

Once stake size exceeds personal tolerance, volatility stops feeling statistical and starts feeling personal.

Key Takeaway

Risk management doesn’t tame volatility — it frames it. By keeping stake size within emotionally tolerable limits relative to bankroll, players prevent normal variance from being misread as extreme or unfair behaviour.

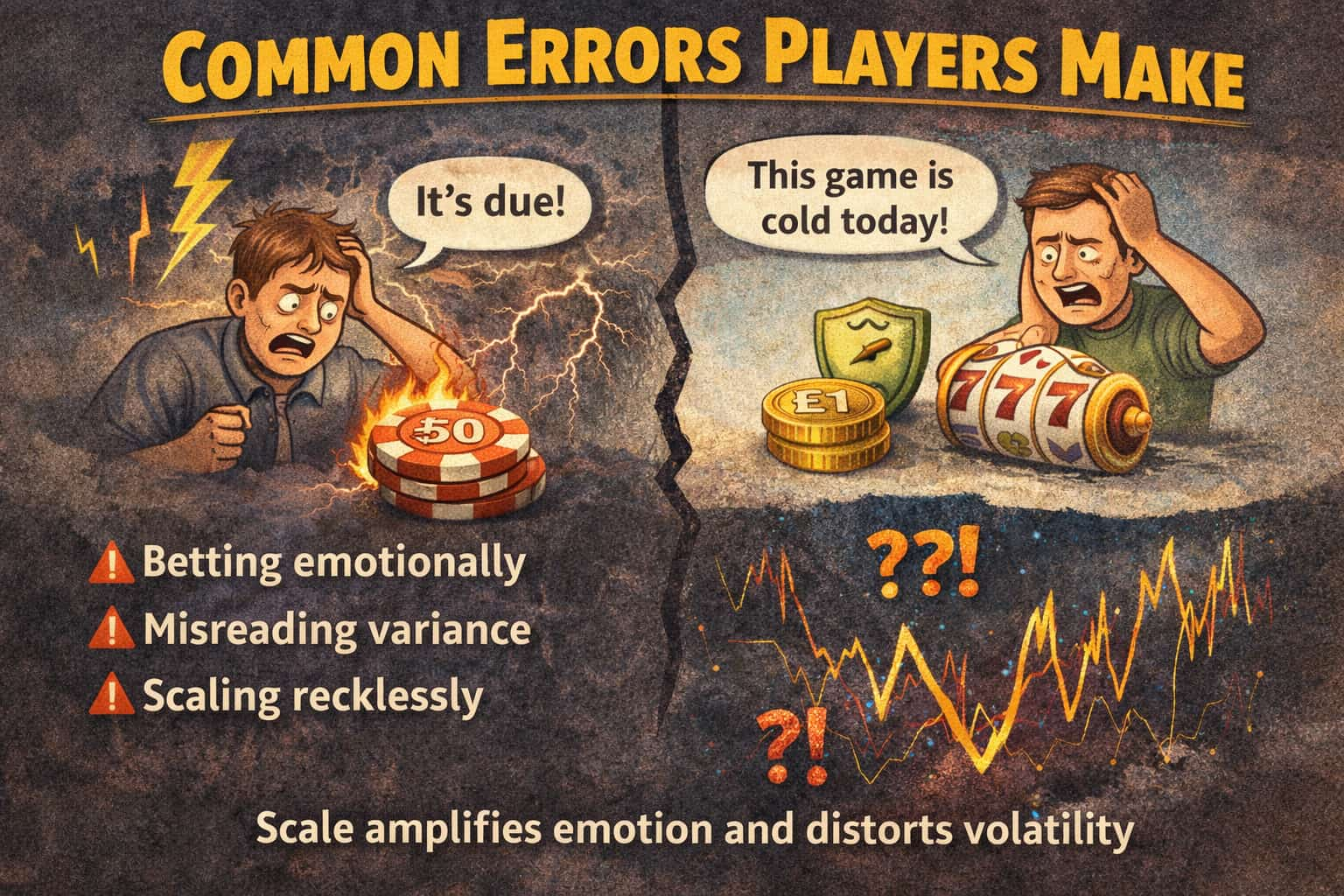

Common Errors Players Make

Most mistakes players make around volatility don’t come from misunderstanding the maths. They come from misreading how bet size alters perception, then reacting emotionally to that distortion.

These errors are extremely common — and easy to slip into once stakes rise.

Mistaking Emotional Intensity for Game Behaviour

One of the most frequent errors is assuming:

- “This game is more volatile than usual”

- “It’s behaving badly today”

- “Something feels off”

In reality, the game is behaving normally. What’s changed is how much each outcome matters.

Higher stakes amplify emotion, which is then misattributed to the game itself.

Chasing Losses Caused by Scale, Not Strategy

When losses feel severe, players often respond by:

- Increasing stake size to recover faster

- Switching games impulsively

- Abandoning previously comfortable bet levels

These actions don’t reduce volatility — they increase exposure to it.

Overvaluing Short-Term Results

| Short-Term Outcome | Common Interpretation | Reality |

| Quick loss | “High volatility” | Small sample variance |

| Early win | “Good session” | Random clustering |

| Dry streak | “Cold game” | Expected behaviour |

Short sessions exaggerate variance, especially at higher stakes.

Ignoring Bankroll Proportions

Players often focus on:

- The absolute size of bets

- The headline win amount

Instead of:

- Stake as a % of bankroll

- Loss tolerance per session

This disconnect leads to bets that feel fine initially but become stressful as variance plays out.

Confusing Comfort With Safety

Low stakes feel safe. High stakes feel dangerous.

But neither changes the game’s volatility — only how visible it is.

Players often:

- Overplay at low stakes because losses feel harmless

- Overreact at high stakes because losses feel urgent

Both distort perception.

Believing Volatility Is “Manageable” Through Intuition

Many players believe they can:

- Sense when to increase or decrease stakes

- Feel when a game is about to turn

- Adapt in real time to variance

These beliefs mirror the same illusion of control seen in other gambling contexts. Intuition reacts to emotion, not probability.

Key Takeaway

Most volatility-related mistakes stem from scale mismatch — betting at levels that amplify emotion beyond tolerance. When that happens, normal variance is misread as extreme behaviour, leading to reactive decisions that worsen outcomes.

Understanding this doesn’t eliminate volatility. It prevents you from fighting it.

Frequently Asked Questions

Does increasing your bet size make a game more volatile?

No. Increasing your bet size does not change a game’s volatility, RTP, or odds. What it changes is how strongly you feel normal variance. Higher stakes make wins and losses more noticeable, which can create the impression of increased volatility.

Why do games feel more “swingy” at higher stakes?

At higher stakes, each outcome represents a larger percentage of your bankroll. This causes:

- Faster bankroll movement

- Stronger emotional reactions

- Shorter tolerance for losing streaks

The maths stays the same — perception changes.

Why do small bets feel safer even on volatile games?

Small bets reduce emotional impact and slow bankroll changes. This makes variance less noticeable and allows more spins per session, which can smooth out results and make volatility feel lower than it actually is.

Do bigger wins balance out bigger losses emotionally?

Not always. Wins are judged relative to stake size, not absolute value. At higher stakes, smaller wins feel less meaningful, while losses still feel painful — which can make sessions feel harsher overall.

How does bankroll size affect volatility perception?

Volatility is felt relative to bankroll, not bet size alone. A £10 bet feels very different to someone with £100 compared to someone with £2,000. The higher the stake as a percentage of bankroll, the more volatile outcomes feel.

Can changing stake size help manage volatility?

Changing stake size doesn’t manage volatility itself — but it does manage exposure to variance. Lower stakes reduce emotional swings and make outcomes easier to tolerate, while higher stakes increase pressure and intensity.

Why do short sessions make volatility harder to judge?

Short sessions include fewer spins, which means results are dominated by randomness rather than averages. This effect is amplified at higher stakes, where sessions often end quickly and outcomes feel extreme.

What’s the most common mistake players make with bet sizing?

The most common mistake is betting at a level that exceeds emotional tolerance, then interpreting stress or frustration as a problem with the game rather than a mismatch between stake size and bankroll.